Is one of your customers taking a little too long to pay you? Before moving on to dunning unpaid invoices, it is essential to determine why these customers are late:

- Miscommunication: you don’t understand each other

- Complicated payment processes: fixed dates, not very accurate accounting etc.

- Dispute about the product or service provided: you do not agree on the implementation

- You are one of the invoices de-prioritized by your client

In this article, we give you all the information about your rights. We also provide you with dunning templates to use when dunning your late customers.

Sommaire

The importance of a solid dunning process for your unpaid invoices

For healthy finances, a company must ensure a “normal” cash flow. In other words, the billing conditions must be respected. Without it, your company cannot cover all its expenses.

Salaries, expenses, marketing: all this has a cost. Eventually, debts can accumulate, putting your company’s growth at risk.

B2B companies are not the best protected. Few companies have implemented a real collection process for unpaid bills. When they do, the actions are most often punctual.

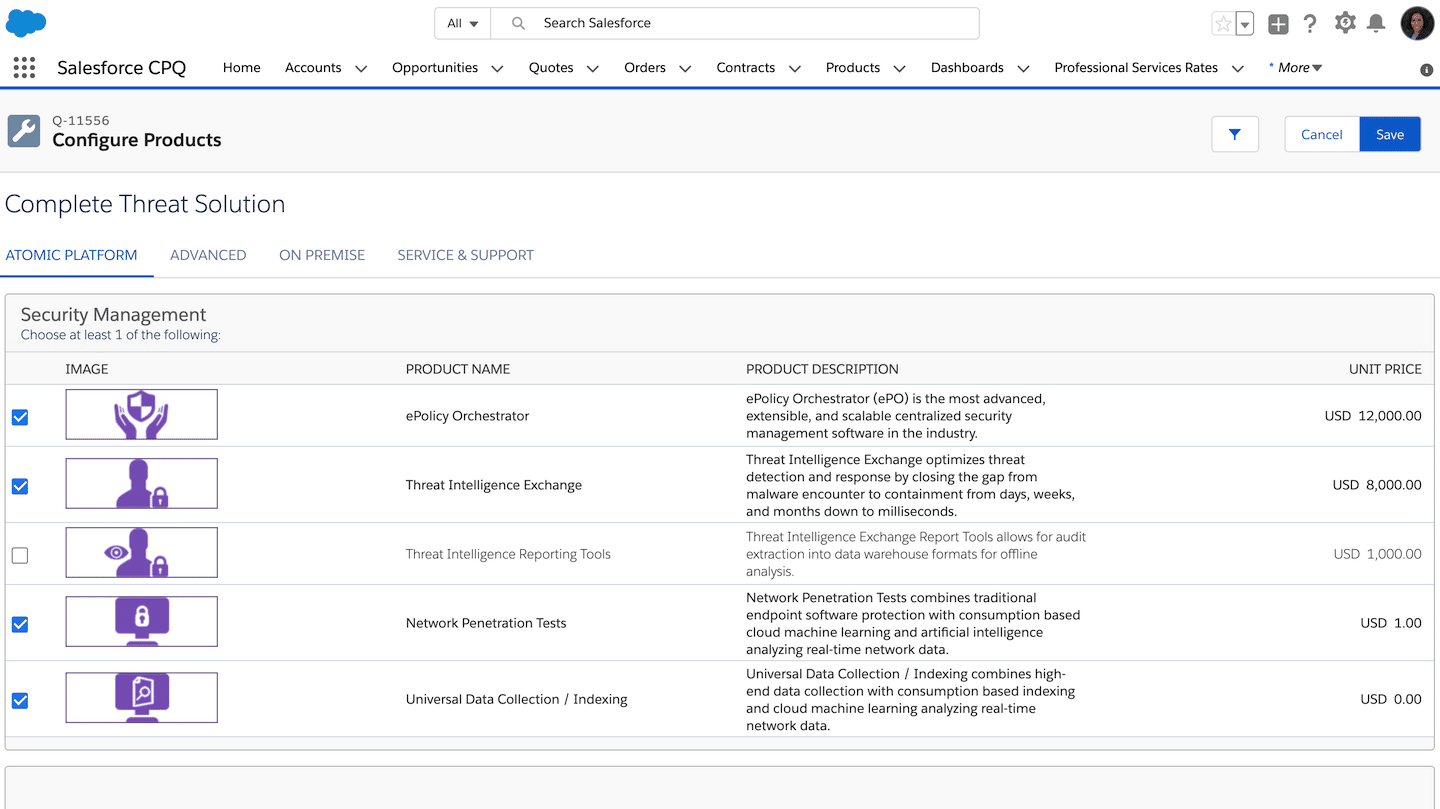

According to the graph above, we can see that 64% of the companies are affected by late payments. As a result, 23% of them cannot employ new employees due to lack of cash.

In order to get paid on time, you can put in place a series of concrete and effective actions. This reminds the customer that they are behind in their payments and therefore, cleans up your finances.

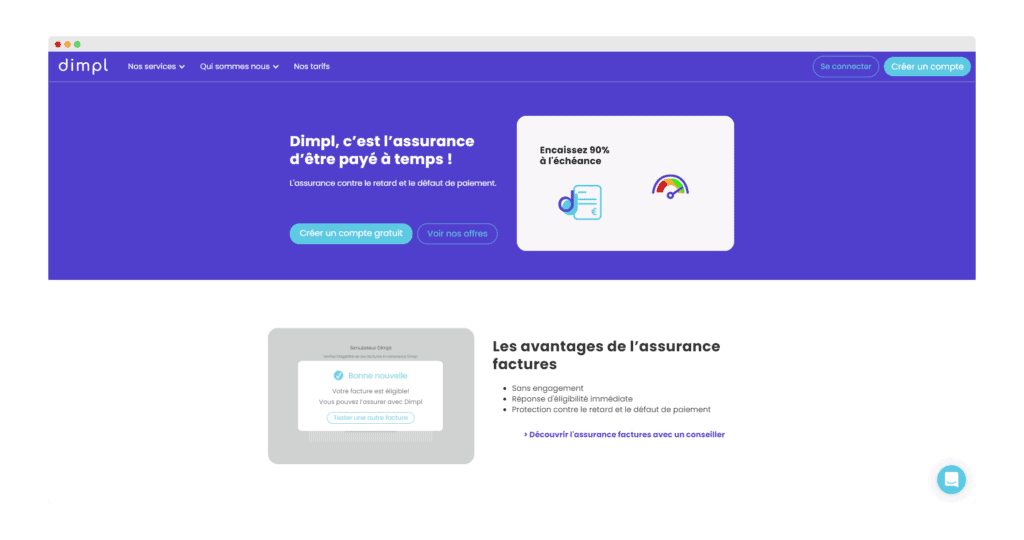

Using a collection software: the most efficient way to optimize your working capital

One of the most effective ways to better control your WCR and keep control of late payments is to use a collection software. This software integrates with your billing tools, and offers two key features:

- Dashboards and reports to monitor the status of your receivables in detail, anticipate potential cash flow needs, and empower your teams with key KPIs such as WCR, expressed in days of sales

- More or less automated reminder tools (depending on taste), integrated with simple and transparent payment methods for customers such as a customer portal, online payment forms, etc.

The best way to get your invoices to the top of the pile is to make the payment experience as simple as possible, and to have clear and explicit communication. These tools are designed to help you see more clearly, but also to help your customers see more clearly.

Collect your outstanding payments in 5 steps

It is normal to ask your customer to pay. You have provided a service, for which you have been contacted. It remains to define the steps to follow in order to call his client to order.

Above all, we invite you to opt for a simple and factual communication. It is also recommended to be approachable without being friendly in your approach. Make it personal and show that you care about the financial health of your business.

In case nothing moves, you can start climbing. For that, we propose you to discover a sequence to follow. However, make sure you are in contact with the right person, from the right department.

We invite you to discover and use this file that allows you to follow the different levels of reminders made by the team for each customer who tends to pay a little late.

#1 Email – 2 business days after the due date

Once the due date has passed by two days, you can begin to take action. It is recommended to send a first reminder email with all the necessary information (invoice, due date etc…).

If it’s a simple oversight on their part, it shouldn’t take long for the customer to confirm the payment. It may also have been done a few hours earlier. In this case, you can request proof of payment.

Sample email:

Subject: {client_identity}: {amount_due}€overdue for {nom_votre_entreprise}

Mail body:

Dear {nom_point_de_contact},

I hope you are well.

I am contacting you regarding your account balance of {total_solde_compte}of which {amount_due} € is pending payment.

Please find the list of our outstanding invoice references: {liste_factures}

You will also find the corresponding PDFs attached to this e-mail if needed.

We would appreciate a prompt payment upon receipt of this email.

If your payment is already in progress, please disregard this notice.

Sincerely yours,

{your name}

#2 Email – 8 business days after the due date

If your first email did not have the desired effect, we recommend waiting a few more days. 8 working days after the due date, send a second reminder.

Opt for a more direct approach. Work on the subject line and your content to make it a little more “authoritative”. It is recommended to focus on the most overdue invoice and display the due date.

Sample email:

Topic: [Rappel] {identite_client} {amount_of_due} € in arrears for {nom_votre_entreprise}

Mail body:

Dear {nom_point_de_contact},

I am contacting you again to inquire about our invoices, for which we are still waiting for payment.

Please note that invoice {invoice_number} was due on {due date}.

In addition, your total balance is now {total_amount_due} €, as the {invoice_references} invoices have not yet been paid.

Could you tell us when we should expect to receive your payment?

If you have already made your payment in the meantime, please disregard this notice.

Sincerely yours,

{your name}

#3 Call: 15 business days after due date

If the first two reminders do not work, you run the risk of having your unpaid invoices turned into bad debts.

For this third step, it is recommended to involve your client’s account manager. He can make a phone call to her.

In the B2B sector, few companies use the telephone to retrieve invoices awaiting payment. The call will provide insight into why the payment has not yet been made.

Both parties then agree on a payment date. Feel free to insist on sending a summary email with the details of your discussion.

#4 Email – 20 business days after due date

While this is likely to be rare, the idea that the customer has not lived up to the commitments made during your call should be considered. In this case, you are encouraged to be more firm.

It is recommended that you send an email 20 working days after the due date. Do not hesitate to add the account manager of your customer in copy as well as the buyer to whom the good, the service could be sold.

It is recommended that you add your client’s finance or accounting team. Emphasize the worrying nature of the observed delays in payment.

Example of an email

Subject: [URGENT] {client_identity}: {amount_due} € overdue for {nom_votre_entreprise}

Dear {nom_point_de_contact},

Despite our previous attempts the {date_envoi_emails} to collect payment of your bills, we are concerned that your outstanding balance still amounts to {amount_due} €.

In fact, our {invoice_references} invoices are all pending payment.

We must remind you that timely payments are necessary for us to operate in a sustainable manner.

Can you give us a definitive date for the above or let us know if you have already made your payment?

Sincerely yours,

{your name}

#5 Mail – 25 business days after due date

In the vast majority of cases, it should not be necessary to send a letter. However, this must be taken into account.

The demand letter is an extra effort that often pays off. For clarity, print and attach your invoices to your letter.

Sample letter:

Subject: Demand letter for your outstanding balance of {amount_due} €.

Dear Sir or Madam,

Despite several reminders to your company, we have still not been able to recover payment of our invoices which are now pending payment {list_references_invoices} and which you will find attached to this letter.

We therefore ask you to proceed with the payment of {amount_due} € within the next 15 days.

If we do not receive your payment or do not hear from you by {deadline}, we will unfortunately have to escalate the situation and resort to legal action.

Waiting to hear from you,

Yours sincerely,

{your name}

Anticipate and prevent the risk of non-payment upstream

There are ways to get your customer to pay an invoice. This does not make the situation any less uncomfortable. In order to avoid this, there are good practices to apply to protect yourself and avoid this kind of problem.

#1 Rely on a solid billing process

Firstly, we insist on the character of the validity of the invoice. For a dunning to be effective, your document must be legally viable.

This is achieved through the appearance of certain mandatory mentions, such as :

- The “Invoice” mention

- An invoice number. These should be numbered in ascending order.

- Your name, address, business name and SIRET number. The same data must also be displayed on the client side.

- The details of your service and the amount of each. Add the payment term

- The specific mentions to the VAT. Self-employed entrepreneurs, if you are not liable for VAT, don’t forget to add the following mention: “VAT not applicable, article 293B of the CGI”.

Salesdorado’s advice

Feel free to use our free downloadable excel & word invoice templates to ensure that your invoices include all the required information.

Finally, the rules for late penalties must be readable. A law passed on July 1, 2019 imposes a minimum of 2.61% of the total amount of the invoice, to which a flat fee of 40 euros is added.

Attention

If these penalties are not indicated in the invoice, or were not mentioned in the estimate, your client is not liable for them. Use the right invoicing tools to ensure that your invoices are well managed!

#2 Establish a healthy business relationship

In addition to being forewarned, every effort should be made to ensure that the business relationship is healthy. Both parties have obligations to each other.

Honor your commitments, be responsive and open to negotiation in your orders. By being clear, respectful and professional, you put all the chances on your side to get paid on time.

#3 Multiply the contacts

A good business relationship is about building relationships. Do not hesitate to discuss and exchange with the representatives of your client’s various departments. This makes it possible to involve all the decision-makers in the ongoing project.

Ultimately, this can allow your business to be considered a priority at billing and settlement time.

#4 Be square with the accounting teams

To avoid being surprised, don’t hesitate to ask questions to your client’s accounting department. Some companies pay upon receipt while others prefer to pay within 15 or 30 days of the end of the month. In case of regular billing, this avoids unpleasant surprises.

Indeed, your teams now have all the information. They can send invoices without mistakes and have a clear and established schedule to follow in the event that payments are missed.

Finally, don’t hesitate to innovate. For example, if a business owner wants to pay you directly by card, you can send him a payment link via Stripe or Lydia. You will pay 1.5% commission but all parties will be satisfied.

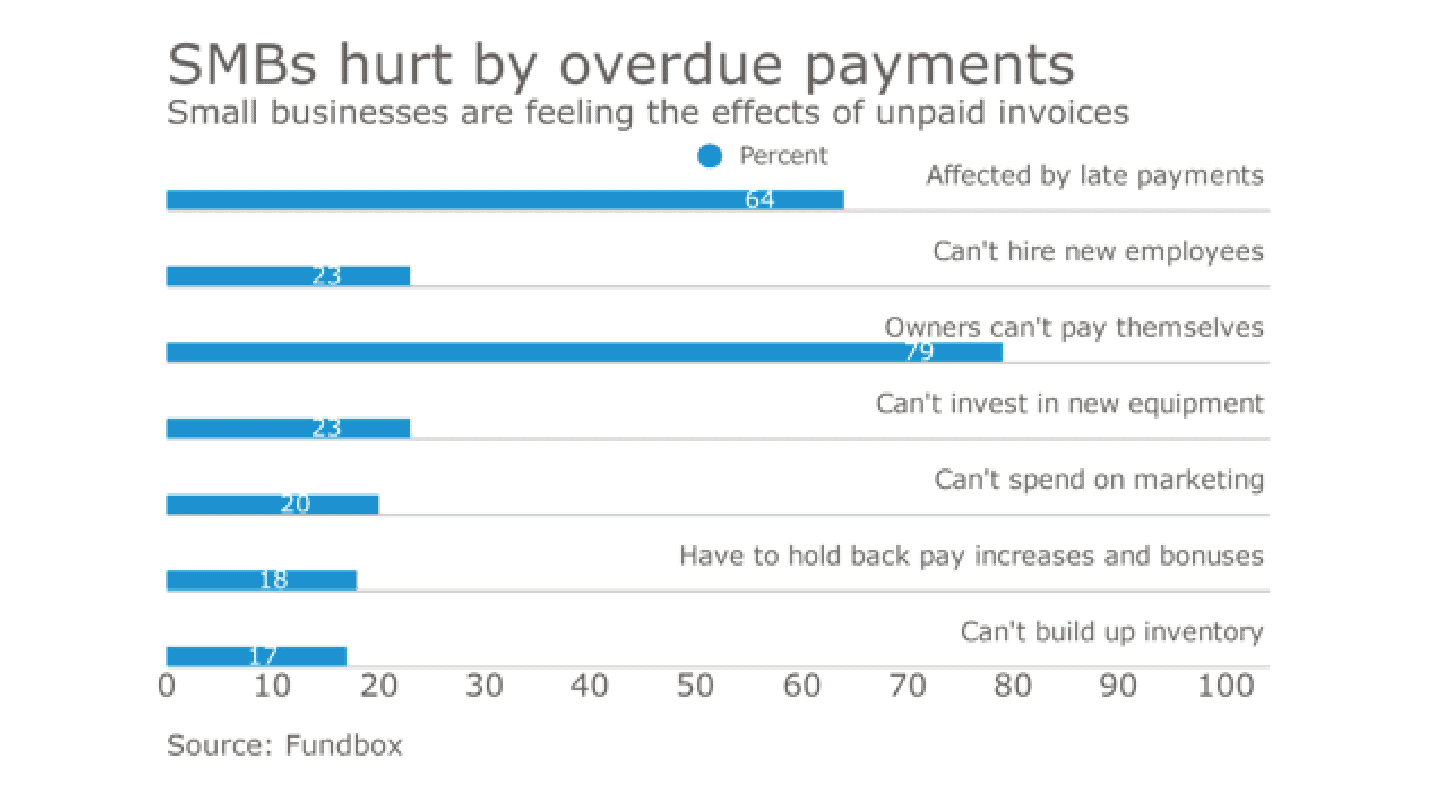

#5 Use factoring

Source : Libeo

Factoring is a misperceived method mainly used by large groups.

This consists of handing over the ownership and management of your invoice to a specialized financial institution. It is called the factor.

Against these invoices, it finances the cash flow requirements. The company then has the funds and does not have to wait for the payment of its invoices.

Attention

Factoring presents a real risk of deterioration of the relationship between you and your customer or supplier.

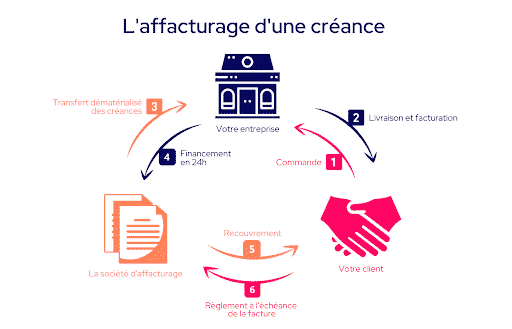

Invoice-based insurance

Invoice-based insurance is a proven system. It works in a very classical way.

Your company subscribes to a contract. This document commits you to an insurer. If the legal or contractual payment deadline is exceeded, you inform the insurer, who takes over.

The latter takes care of dunning and collection of pending payments. We recommend you to turn to the Dimpl tool if this solution seems to be suitable for your needs.

Good to know

In the “no commitment” version, Dimpl does not charge you any fees! The tool pays itself via a small percentage (2%) of your invoice. So you have nothing to go on.

How to react to an unpaid bill?

Late payments are quite common. The processes related to regulations can sometimes be quite tedious, especially in large groups.

In the event that this happens, don’t hesitate to remind your customer that you are liable for penalties and a lump sum payment.

You are encouraged to mention this in your estimate and invoice. Otherwise, the customer does not have to pay you for this part. You can then follow up in a friendly but firm manner, using the models presented.

My attempts at amicable reminders have gone unanswered, what can I do?

When faced with a customer who does not respond, do not hesitate to strengthen your approach. The demand letter is very effective. It is a simple letter, in which you invite your client to respect his commitments.

Failure to do so may result in prosecution. This is a practical method that does not require the use of a lawyer. You can write the mail yourself.

This document must be dated, bear the words “mise en demeure” and indicate very explicitly the date of execution.

Feel free to allow an additional one to two weeks. The objective is to get your money back, by muscling your approach.

The idea is not to create a conflict that may result in more impactful and, more importantly, more expensive lawsuits. Finally, the letter must be sent by registered mail with return receipt.

We invite you to use our sample demand letter, in order to write a coherent letter to your client.

Despite my formal notice, my client shows no sign of life.

If the formal notice does not work, you can start legal proceedings.

It can take three forms:

- Simplified collection for debts of less than 4,000 euros: this procedure requires the intervention of a bailiff. You can contact him via the Credicys platform. The bailiff collects the file and sends a registered letter. It initiates the collection procedure. It is a paying practice (14,92€ for the filing of the file to which we add a percentage of the recovered amount).

- The injunction to pay: it is the commercial court which deals with the file. There are two ways to complete an application. If you go through Infogreffe, you will have to pay 35.21 euros. You can also send the Cerfa form n. 12946*01 to the competent court. If the amount to be recovered exceeds 10,000 euros, a lawyer must take care of it. Accompany your request with all the relevant supporting documents. If the judge rules in your favour, it is up to you to convey the verdict to your client.

- The provisional injunction and the summons for payment: this way of proceeding allows you to obtain the recovery of your invoices, within 15 days. You must provide all the supporting documents relating to your application to the court. Here, your client can defend himself. It is a legal document, drafted and transmitted by a bailiff. The document requires the client to appear on a pre-determined date.

Who to contact in case of unpaid bills?

Instead of going to court, you can also use company mediators. This is a free service offered by the Ministry of Economy and Finance.

A certified person arbitrates the disagreement between the professionals. You can apply directly on the dedicated online platform.