The customer acquisition cost – CAC – is an indicator that allows you to measure the profitability of your sales & marketing efforts since it corresponds to the cost necessary to acquire a customer. It is very similar to the cost per lead, traditionally preferred by marketing teams.

While its calculation is fairly straightforward, it needs to distinguish several levels of CAC and be compared to other indicators such as customer lifetime (LTV) to make it truly operational.

In this article, we present the different uses & definitions of CAC, and the methods to deduce the efficiency & effectiveness of your sales & marketing investments.

Sommaire

#1 What is the purpose of acquisition cost?

What is the CAC? Operational definition

The cost of acquiring a customer (CAC) is the total cost you spend to “win” a new customer. It usually includes the following elements

- Advertising costs(Facebook Ads, Linkedin Ads, Google Adwords, etc.)

- Salaries of marketing teams

- Costs related to your sales teams

Then divide that cost by the number of customers you acquire. This is a really useful figure to calibrate your investment and ensure you are making the right decisions to grow your business.

Example: What does this mean in practice in a company?

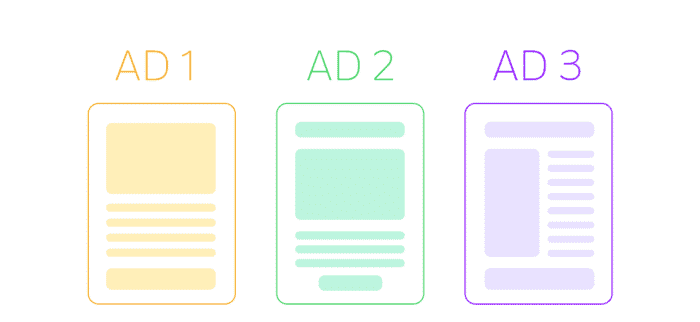

Let’s say you have bought 3 advertisements at 100 clicks each, but they don’t cost you the same in terms of clicks. Consider the following example:

- Ad A: €5 per click, i.e. €500. Your 100 clicks get you 5 customers

- Ad B: €10 per click, or €1000. 100 clicks get you 15 customers

- Ad C: €20 per click, or €2000. But this time, 100 clicks bring you 40 customers

On a cost-per-click basis, Ad A is preferred as it is theoretically cheaper.

But if you divide the total cost of an advert by the number of customers you get, advert C is the most interesting, as you will only pay €50 for each new customer, whereas advert B costs you €67/customer, and advert A costs you €100/customer.

Operationally, with a growth objective (assuming that €100 is an acceptable CAC), we seek to develop the volume on ad C (even if it means increasing the CAC of this ad a little along the way). For profitability purposes, on the other hand, we would rather seek to optimise ads A & B.

Pro tip

Conversion rates can vary greatly between channels and campaigns. Hence the need to come to a “universal” metric: the cost of acquisition. It should be noted that not all customers are the same, and that the cost of acquisition is an interesting variable for monitoring costs (or budget), but that it does not (yet) allow profitability to be measured.

Why is the CAC calculation important?

The CAC calculation can be used in two contexts:

Evaluating a company’s strategy and positioning

The CAC is used here to analyse the development potential of a company. In this way it can be determined:

- The profitability of a business by looking at the difference between the cost of a new customer and the money that customer brings in

- The growth potential by comparing the evolution of the CAC over the last few months with the evolution of the volume of new customers. If the CAC increases little, but the volume rises sharply, the company still has a lot to offer. On the other hand, if the CAC explodes while the volume of new customers is low, it will be necessary to think about quite radical changes in order to return to a healthy growth trend.

Evaluate & optimise the operational performance of a company

To align sales with marketing, the CAC can be used to optimise the return on advertising and sales investments (recruitment). In other words, the idea is to reduce the cost of acquiring a customer in order to increase the margin and therefore the company’s profit, or to maintain it as best as possible in contexts of growth or hyper-growth.

Whether the context is one of growth or one of exploitation (i.e. optimising profitability), the CAC is THE operational metric that sales & marketing teams follow to evaluate the performance of their efforts.

Be careful, however, to always put it in parallel with the volume of new customers, and the average income of the customers in question, otherwise it would be enough to stop spending to obtain a CAC of … zero.

With a view to optimising profitability, there is a “sweet spot” (an ideal value) between a CAC that is too low, which means that the competition is allowed to take market share too easily, and a CAC that is too high, which means that the company buys customers at a higher price than the competition (and therefore cuts into its profitability, compared with the rest of the market).

#2 How to calculate the cost of acquisition?

The formula

To calculate the CAC, all the costs associated with acquiring new customers (marketing and sales expenses) are added together and divided by the number of customers acquired. This calculation is usually done for a specific period, such as a fiscal year or quarter.

Example: A company spent $1000 on marketing in one year and acquired 2 new customers.

- 1000 / 2 = 500. The CAC is $500/customer.

- If it has acquired 2x as many clients, the CAC is 2x less, or $250.

This formula is fairly simple, but the total expenditure can add up to many factors, including the cost of multiple marketing strategies (including lead generation strategies) and staff salaries.

What costs should you include in your CAC calculation?

Total sales and marketing expenditure generally involves the following three elements:

- Salaries

- Tools

- Expenditure

Everything that falls into these categories must be included in the calculation of your CAC.

Pro tip

Think of it this way: you have to include everything in the income statement that contributes to the acquisition of new customers. You are trying to maximise your profitability: by excluding items, you are masking the real profitability of a customer.

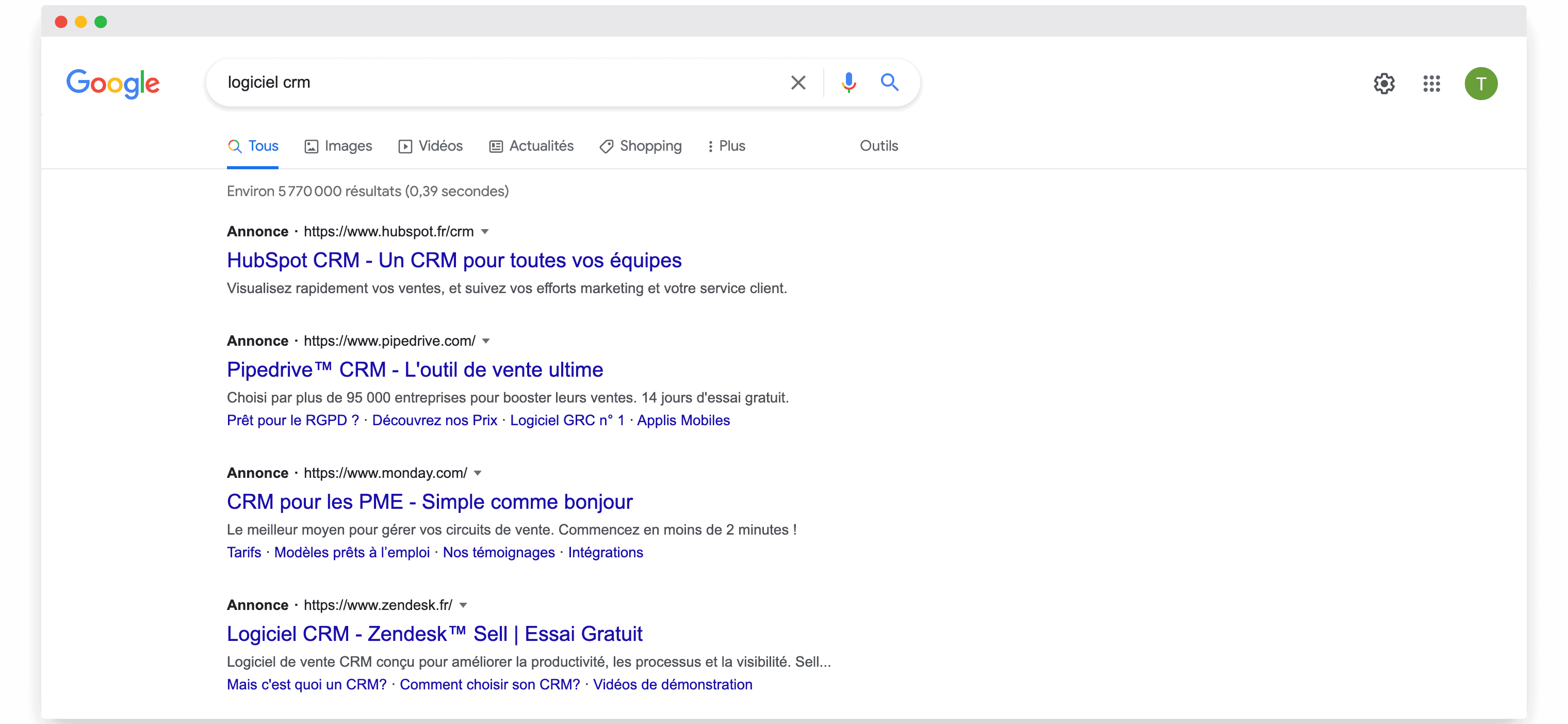

Example: an online CRM software company (SaaS)

This company provides CRM software. With regard to its costs,

- The cost of distribution is generally quite low as most companies leave the onboarding to CRM integrators. The cost of retention is quite low as it is quite expensive to change CRM software.

- The cost of referencing is high because the company is very well referenced in search engines and relies heavily on content production to generate customers.

- It pays for a sales support team in its call centres in the United States.

- It pays for many strategic partnerships that ensure a steady supply of customers.

Thus, according to the following calculation, it spends €235 to acquire a new customer:

- Total cost of sales call teams: €1,500,000/year.

- Total cost paid to strategic alliance partners: €450,000/year.

- Total cost of search engine optimisation: €400,000/year.

- Total new customers generated in the year: 10,000

Customer acquisition cost: €2,350,000 / 10,000 customers = €235

Attention

This is only the beginning of the CAC calculation: we have not yet taken into account the money brought in by each customer, which is calculated using the LifeTime Value (LTV) of a customer. We could be satisfied with the average basket over the first month, or the first purchase, but we have to think more and more in terms of LTV.

#3 How to optimise the cost of acquisition?

Improve your conversion rates

The idea is to get more customers without increasing advertising spend: it is about optimising the CAC by increasing the return on investment (ROI), but without reducing costs.

This can be done by improving the lead conversion rate, i.e. converting more leads into paying customers.

How can this conversion rate be improved in practice?

The only real lever for conversion rate optimisation is segmentation.

The more precise you are in your target/message pairs, the better you will be able to convert. But this precision comes at a cost: operational complexity.

The optimisation of the CAC is almost always a trade-off between operational complexity and scalability.

Example: If we segment more, we will be more efficient and we will earn 10€ more per customer, which allows us – with the same budget – to acquire even more customers. But we also increase the complexity of our campaigns, and it will be more difficult (and more time consuming and expensive) to launch a new one. And the cost of maintaining these campaigns also increases significantly.

Going further

- Examples of landing pages The 25 best landing pages

- Comparison Of Landing Page Creation Tools Salesdorado

- 10 Tips For Building Optimised Landing Pages For Lead Generation Salesdorado

Turn your existing customers into ambassadors

There are two options for this:

Create a partnership programme

In fact, it’s about creating a kind of reseller programme: the best way to reduce your CAC is to have other companies market, sell and service your customers.

By setting up the right partnerships, resellers not only refer relevant prospects to you (i.e. it is easy to convert them into customers) but also market to you through their own marketing channels.

In this way, they close business themselves and even help you to retain your customers and sell them additional products.

Our opinion

Once you have trained a partner, they can sell for you for years to come because the success of their business depends on the success of yours.

Use a sponsorship programme

A referral programme can encourage existing customers to promote your business through a freemium product or service extension.

The principle is simple: if every tenth customer brings you an extra customer, then a customer is actually worth 1 customer + 10% of a customer, i.e. 1.1 customers. You multiply your CAC by 1 / 1.1 – so almost 90%.

A sponsorship programme also allows you to:

- Rewarding loyal customers: it is known that they contribute much more to the company’s results than regular search for new customers or recycling them.

- Access new sales opportunities: customer ambassadors get a taste of premium aspects of your products that they may have thought about before but never took the plunge. They are therefore more likely to choose to pay for these extensions to maintain the freemium feature, or even to buy more.

In short, the sponsorship programme is a kind of virtuous circle of growth, commonly known as a “growth loop”.

Beware of measurement costs

Starting a referral programme means that you are paying your customers (in one way or another) to refer you. But in reality, some of your customers are already referring you! For free! So offering a reward essentially allows you to measure this channel, at least initially. But once you measure it, you can work on it, and optimise the performance. Be aware of this and don’t isolate the cost of referral acquisition from the rest of your marketing operations. To properly measure the increment brought by the programme, you need to measure the overall impact on acquisition, including poorly measured or unmeasured acquisition.

Building an asset

SEO, by targeting top of the channel keywords, will “capture” customers who are not familiar with your brand and therefore take longer to convert and are too expensive for marketing techniques.

The idea here is to reduce the CAC without increasing advertising expenditure, by playing on non-paying channels and particularly on so-called organic traffic.

Definition

Organic traffic on the Internet measures how many visitors come from a query made on a free search engine. Good SEO allows visitors to click through to your site without costing you a penny.

In addition, good SEO produces more sustainable results, as organic search acts as a flywheel and continues to produce organic traffic, whereas paid traffic stops when you stop buying ads.

Our opinion

Companies can remove brand-related keywords from advertising spend, such as “Carrefour”: if someone types this word into Google, they will either search for the nearest shop or the website. Buying a keyword that matches a specific item only increases the CAC.

#4 The real issue: The LTV / CAC ratio

What is LTV?

Customer lifetime value (CLV, or sometimes LTV) refers to what a customer brings to your business over the course of his or her “lifetime” as a buyer.

Of course, the lifetime of a customer and the amount of money they spend varies considerably from company to company and from sector to sector. Therefore, the specifics of your business must be taken into account.

However, some elements of the CLV are relevant to many companies:

- Average customer lifetime: the length of time an individual remains a customer.

- Customer retention rate: percentage of customers who buy again.

- Profit margin per customer: expressed as a percentage, it takes into account the CAC as well as other expenses such as the overall cost of goods sold (i.e. production and marketing costs), and the operating cost of the business.

How to calculate the profit margin per customer?

Net income per client (what they spend minus the CAC) / estimated income of the client over the duration of the relationship * 100.

- Average amount spent by a client in their lifetime: amount spent by each client in their lifetime / number of clients.

- Average gross margin per customer: can be calculated over a specific period of time (one year) or over the lifetime of the customer. In this case, take the profit margin per customer over their lifetime, divide it by 100, and multiply by the amount they spend over their lifetime.

How to calculate the average gross margin?

Calculation over the lifetime of a customer: profit margin per customer over its lifetime / 100 * amount it spends over its lifetime.

In reality, we should only talk about the CAC / LTV ratio, to compare the CAC with the income that is the LTV. A cost is nothing without associated income.

There are two options for this:

- Reducing the CAC

- Increasing LTV

Attention

For a long time, companies thought in terms of the average basket spent by the customer during an order. However, a customer is not necessarily profitable from the first order, which is why today we calculate his LTV more.

Increase the perceived value of your offers

Understanding what matters to your customers will increase their satisfaction and thus increase your LTV.

The value of your offering is totally subjective: just because you add new features similar to those of your competitors does not mean that the perceived value of your offering will change.

It is better to spend time interacting with your customers (this is one of the big trends in CRM software), via surveys or emails, to determine what best suits their needs.

Pro tip

You can use statistics such as customer retention rates but also more subjective data such as customer reviews, looking for correlations between these different data.

Optimising the customer experience

This is essential: simply put, if your customer has a good experience with your company, they are more likely to return, which increases their LTV. A better customer experience means a higher LTV and therefore a better LTV/CAC ratio.

Of course, you can optimise your ads indefinitely, but there is a limit to how effective they can be, and the costs always increase. It’s all about focusing on the customer once they are on your website.

The idea is to establish a real relationship with them: provide them with lots of information about your products, set up good support, offer a variety of payment and delivery options.

There are huge benefits to creating a fantastic customer experience both on site and post purchase. It’s a way to build customer loyalty and therefore value, while boosting word of mouth and overall brand exposure, which also helps to drive down CAC on paid channels.

Our opinion

Customer experience is an area that is far too underestimated. While your competitors may be obsessed with ad copy and creative, you will see ten times the growth by working on the experience on your site. If this scares you, it’s one of the benefits of implementing CRM software.

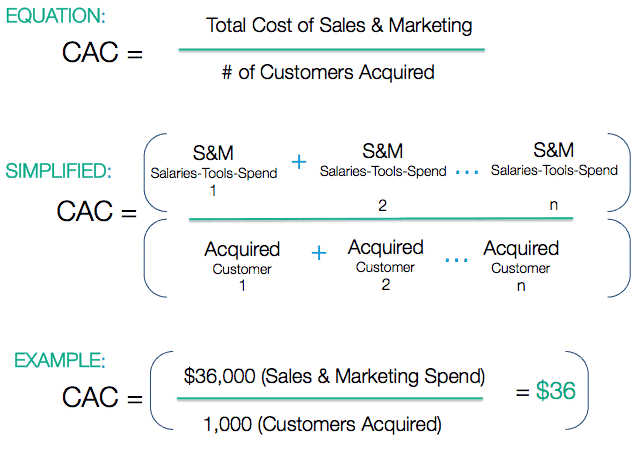

How to calculate the CAC: The formula

The CAC of a company is calculated by dividing all sales and marketing costs by the number of new customers acquired in a given period.

For example, if John spent $36,000 to market a bag and 1,000 people bought his product in one week, his cost of acquisition for that week is $36.

Why calculate the CAC / LTV ratio?

It is the ratio that represents the return on investment (ROI) of all sales and marketing efforts in relation to the new customers obtained through their implementation. It is an indispensable indicator of the effectiveness of different sales strategies.

The CAC is also a key measure used by revenue managers to better understand the drivers of their business model.

What is a good CAC?

This largely depends on the type of industry and the strategies a company uses to obtain new customers.

A widely accepted CAC/LTV ratio in the software world (SaaS) is 3:1, for example, but let’s remember that gross margins in the software world flirt with 90%.

To decide on a CAC target, focus on the gross margin you get per customer (based on the LTV and profit margin per customer calculation detailed above), take a desirable or desired operating margin from this, and deduce the maximum acceptable acquisition cost.

Attention

This acquisition cost is a marginal acquisition cost. We’ll explain what that means in more detail later 👇

What is the marginal CAC?

So far we have looked at the operational CAC, which is the amount a company spends on sales and marketing divided by the number of customers it has obtained. But the value of the CAC is relative, hence the calculation of the strategic (or marginal) CAC.

The number of historical customers in a business generally contains customers who arrived through paid sources (SEM, SEO, Facebook ads) and unpaid (organic traffic).

Some marketing techniques are scalable, others are not. They may even have reverse economies of scale. Customer acquisition is a bit like drilling for oil. You can dig in the right place and it flows, until it runs dry and you have to find another one.

The concept of the marginal CAC is used to solve this problem. If you are thinking about future sales, you want to know the cost of your next set of customers, the marginal customer CAC.

Example: an e-commerce entrepreneur has a historical CAC of €150. He has foreseen that these costs will decrease in the long term thanks to the development of his brand, his notoriety, and his customer portfolio.

If we look at the distribution of the costs included in the CAC,

- The organic channel is by definition free

- Only the cost of the pay channel will change: in future it will be 300 euros.

So the marginal CAC of this company is that of the paying channel, which is increasing exponentially while following a fairly strong logic of diminishing returns: it is therefore possible that, contrary to what you estimate, your marginal CAC in the future will increase.

Our opinion

The marginal CAC is very important: by looking at your operating CAC, you can judge that you are globally profitable. But your growth is not necessarily profitable: this is the bias of averages. If each additional customer costs you more than it brings in, you need to change your acquisition strategy, and quickly (!)